Wage Limit For Social Security 2025

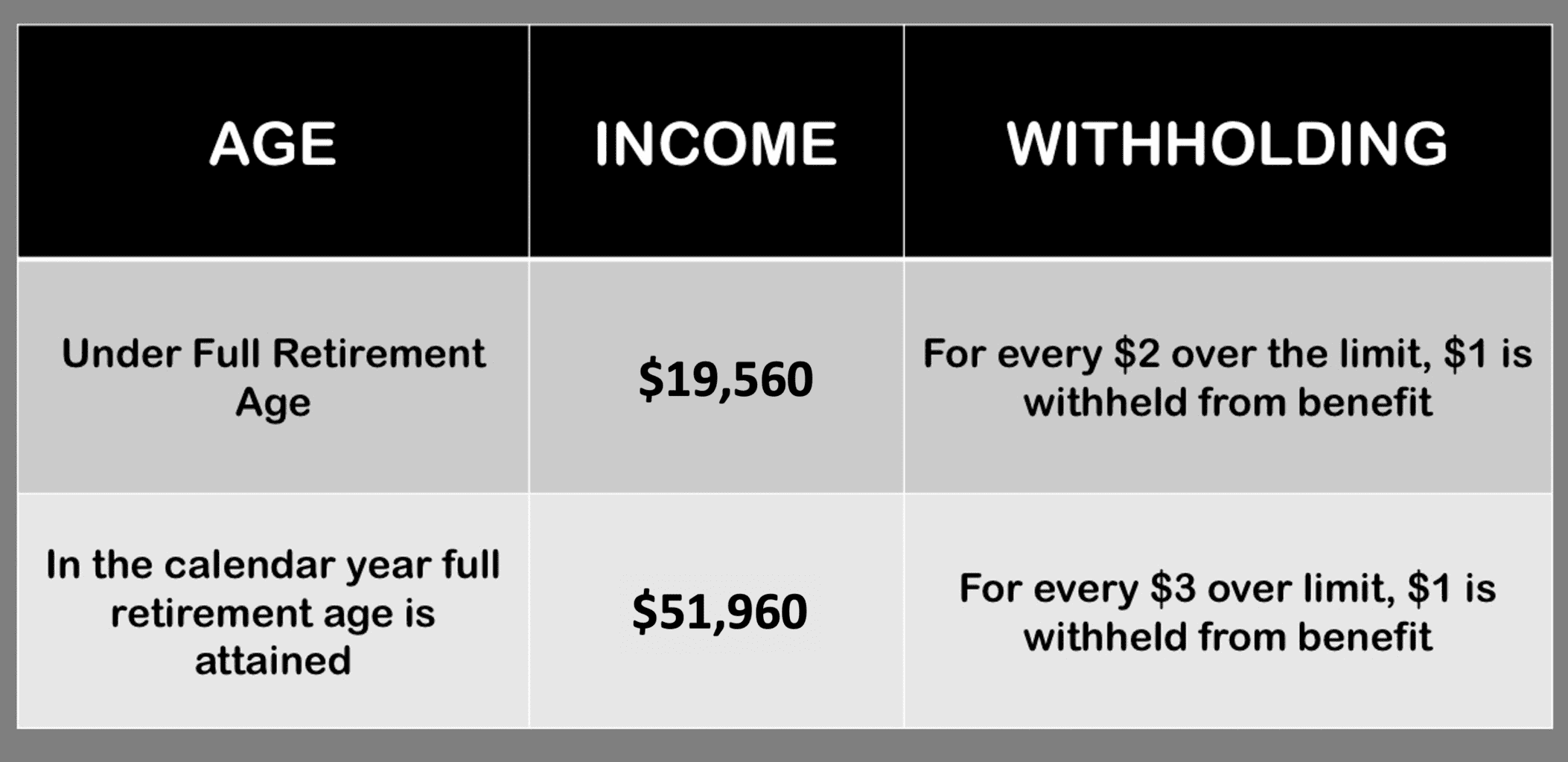

Wage Limit For Social Security 2025 - 2025 social security earnings limit Social Security Intelligence, If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $59,520. By law, some numbers change automatically each year to keep up with changes in. Social security (oasdi only) $ 160,200 $ 168,600 medicare (hi only) no limit.

2025 social security earnings limit Social Security Intelligence, If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $59,520. By law, some numbers change automatically each year to keep up with changes in.

As a result, in 2025. Here’s what every retiree should know about social security in 2025.

2025 Social Security Limit YouTube, Given these factors, the maximum amount an employee and employer. It's the 2025 wage base limit, and the wage base limit changes over time due to wage growth.

By law, some numbers change automatically each year to keep up with changes in.

Wage Limit For Social Security 2025. In 2025, this limit rises to $168,600, up from the 2023 limit of $160,200. Social security (oasdi only) $ 160,200 $ 168,600 medicare (hi only) no limit.

Social Security Limit 2025 Social Security Intelligence, The average monthly benefit is $1,907. Individual taxable earnings of up to $168,600 annually will be subject to social security tax in 2025, the social security administration (ssa) announced.

Learn About Social Security Limits, As a result, in 2025. The average monthly benefit is $1,907.

The wage base limit is the reason why there's a maximum social security.

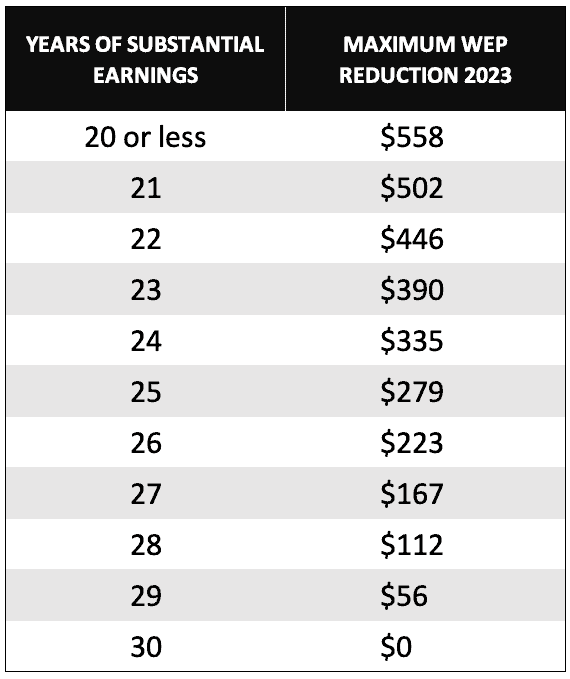

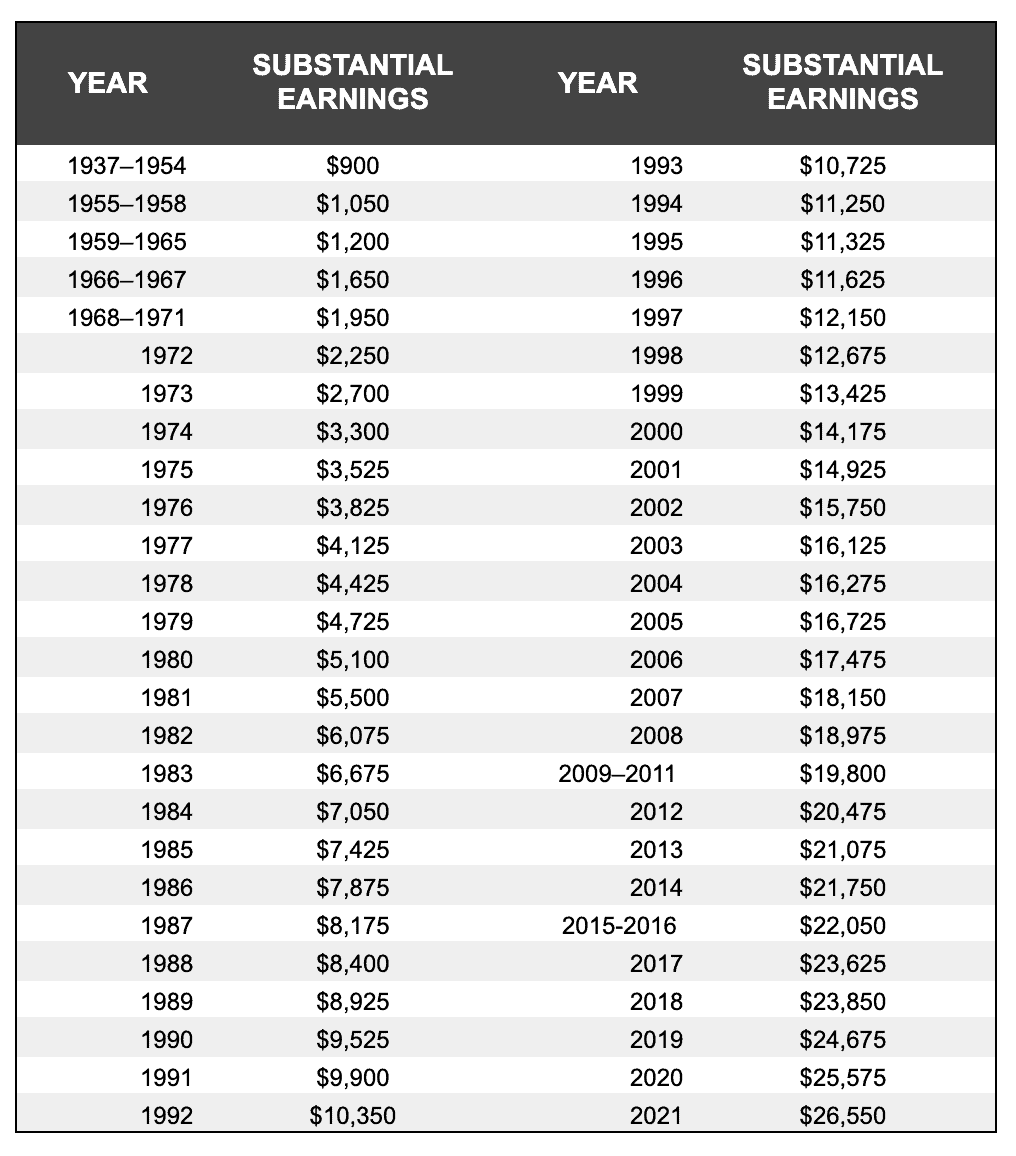

Substantial Earnings for Social Security’s Windfall Elimination, On average, social security retirement benefits will increase by more than $50 per month starting in january. The wage base limit is the reason why there's a maximum social security.

If you will reach full retirement age in 2025, the limit on your earnings for the months before full retirement age is $59,520.

Substantial Earnings for Social Security’s Windfall Elimination, The average monthly benefit is $1,907. This policy affects beneficiaries under full.